August Newsletter 2021

|

Parable Financial Network Parable Financial Network |

August 2021 Newsletter |

A Prayer for When Life Gets You Down By Carrie Lowrance Sometimes it’s hard to know how to pray and even what to pray when life gets you down. In my own experience, I always pray for three things: wisdom, discernment and for God’s will to be done. 1. Pray for WisdomWhen we are in the midst of a storm and have to make heavy decisions that seem to have no answers, it can seem like wisdom is eluding us. It is always wise to first ask God for wisdom in order to make decisions. We must not lean on our own knowledge and understanding. According to Proverbs 4:7, wisdom and good judgment are some of the most important things to acquire. 2. Pray for Discernment

It is crucial to pray for the ability to discern God’s voice, for it to be amplified beyond a doubt. We all discern His voice in different ways, from hearing His voice in our head to a feeling of utter peace and stillness. For some of us he speaks very loud and clear. Regardless, praying for discernment helps your spirit weed out the deceiver from a spiritually sound answer. 3. Pray for God's WillWe sometimes get caught up in how we want things to work out or how we think things should go. It’s part of being human. When you realize you’re doing this, stop and pray and ask God for his will to be done. Give Him the praise and the glory because you know you are exactly where He wants you in order to teach you something or for you to grow. Are things so hard right now that you don’t even know what to pray? Let these words be your cry. Dear Lord, times are really hard right now and life has really got me down. I don’t know what to do. I ask that You bestow Your wisdom upon me. I don’t want to lean on my own knowledge anymore, because it has let me down so many times. I need to hear Your voice. Give me the discernment to hear Your voice and Your voice alone. Speak to me in the way You know I will hear you best. I also pray for Your Will, Lord. I give You the praise and the glory in my circumstances because I know that I am exactly where You want me. I know this is to teach me something or to help me to grow. No matter what, I trust you and ask You to show what is best in this situation. In Jesus Name I pray. Amen.

What Is a Required Minimum Distribution?A required minimum distribution (RMD) is the annual amount that must be withdrawn from a traditional IRA or a qualified retirement plan (such as a 401(k), 403(b), and self-employed plans) after the account owner reaches the age of 72. The last date allowed for the first withdrawal is April 1 following the year in which the owner reaches age 72. Some employer plans may allow still-employed account owners to delay distributions until they stop working, even if they are older than 72. RMDs are designed to ensure that owners of tax-deferred retirement accounts do not defer taxes on their retirement accounts indefinitely. You are allowed to begin taking penalty-free distributions from tax-deferred retirement accounts after age 59½, but you must begin taking them after reaching age 72. If you delay your first distribution to April 1 following the year in which you turn 72, you must take another distribution for that year. Annual RMDs must be taken each subsequent year no later than December 31. The RMD amount depends on your age, the value of the account(s), and your life expectancy. You can use the IRS Uniform Lifetime Table (or the Joint and Last Survivor Table, in certain circumstances) to determine your life expectancy. To calculate your RMD, divide the value of your account balance at the end of the previous year by the number of years you’re expected to live, based on the numbers in the IRS table. You must calculate RMDs for each account that you own. If you do not take RMDs, then you may be subject to a 50% federal income tax penalty on the amount that should have been withdrawn. Remember that distributions from tax-deferred retirement plans are subject to ordinary income tax. Waiting until the April 1 deadline in the year after reaching age 72 is a one-time option and requires that you take two RMDs in the same tax year. If these distributions are large, this method could push you into a higher tax bracket. It may be wise to plan ahead for RMDs to determine the best time to begin taking them. Please contact the office wiht any questions concerning your RMD. Don't Let Debt Derail Your RetirementDebt poses a growing threat to the financial security of many Americans — and not just college graduates with exorbitant student loans. Recent studies by the Center for Retirement Research at Boston College (CRR) and the Employee Benefit Research Institute (EBRI) reveal an alarming trend: The percentage of older Americans with debt is at its highest level in almost 30 years, and the amount and types of debt are on the rise.

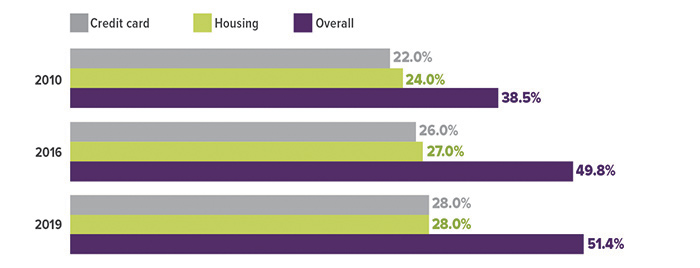

Debt Profile of Older Americans In the 20-year period from 1998 to 2019, debt increased steadily for families with household heads age 55 and older; in recent years, however, the increase has largely been driven by families with household heads age 75 and older. From 2010 to 2019, the percentage of this older group who carried debt rose from 38.5% to 51.4%, the highest level since 1992. By contrast, the percentage of younger age groups carrying debt either rose slightly or held steady during that period. Mortgages comprise the largest proportion of debt carried by older Americans, representing 80% of the total burden. According to EBRI, the median housing debt held by those age 75 and older jumped from $61,000 in 2010 to $82,000 in 2019. The CRR study reported that baby boomers tend to have bigger debt loads than older generations, largely because of pricey home purchases financed by small down payments. Consequently, economic factors that affect the housing market — such as changes in interest rates, home prices, and tax changes related to mortgages — may have a significant impact on the financial situations of both current and future retirees. Credit-card debt is the largest form of nonhousing debt among older Americans. In 2019, the incidence of those age 75 and older reporting credit-card debt reached 28%, its highest level ever. The median amount owed rose from $2,100 in 2010 to $2,700 in 2019. Medical debt is also a problem and often the result of an unexpected emergency. In the CRR study, 21% of baby boomers reported having medical debt, with a median balance of $1,200. Among those coping with a chronic illness, one in six said they carry debt due to the high cost of prescription medications. Finally and perhaps most surprisingly, student loan obligations are the fastest-growing kind of debt held by older adults. Sadly, it appears that older folks are generally not borrowing to pursue their own academic or professional enrichment, but instead to help children and grandchildren pay for college. Debt and the Age 75+ Population Percentage of those age 75 and older with debt, by type

Source: Employee Benefit Research Institute, 2020 How Debt Might Affect Retirement Both the CRR and EBRI studies warn that increasing debt levels may be unsustainable for current and future retirees. For example, because the stress endured by those who carry high debt loads often results in negative health consequences, which then result in even more financial need, the effect can be a perpetual downward spiral. Another potential impact is that individuals may find themselves postponing retirement simply to stay current on their debt payments. Yet another is the risk that both workers and retirees may be forced to tap their retirement savings accounts earlier than anticipated to cope with a debt-related crisis. If you are retired or nearing retirement, one step you can take is to evaluate your debt-to-income and debt-to-assets ratios, with the goal of reducing them over time. If you still have many years ahead of you until retirement, consider making debt reduction as high a priority as building your retirement nest egg.

The 2021 retirement account annual maintenance fee is due on October 29, 2021. This fee covers the costs associated with the recordkeeping of your account and reporting required by the IRS. If you would like to pay the fee from your bank account or your nonretirement brokerage account, contact your broker/dealer. If you do not provide payment instructions, the fee will be deducted from your retirement account on November 22, 2021. If funds are not available to cover the fee, your account may receive an unpaid fee posting. Your broker/dealer may sell any or all of your retirement assets to satisfy the fee and any associated expenses such as brokerage commissions and/or liquidation charges. For information about the annual fee, refer to the Retirement Account Customer Agreement or contact your broker/dealer (912)387-0111. Jan Elkins Clark will be out of the office August 16-20.

Father God, We come to you today, with all the faith and trust in this time of the pandemic. We bring the administrators, principals, professors, teachers, school secretaries, the support staff, and the maintenance staff of our schools and universities before you. We pray for your blessings over their lives, their work, their livelihood, and their families. Guide them with your wisdom. May they be empowered to see the needs of their students and to inspire those under their care. We bring our parents, guardians, and caregivers of our students before you. They have to make decisions that require your wisdom, understanding and insight. When they feel overwhelmed, be present in their lives. We bring before you our students who will either be educated online, at home, or in person in our schools. As they pursue their education in the midst of the pandemic, enlighten their minds. May they grow in grace and wisdom. Amen |

|

|

|

|